This story appears in the October issue of Utah Business. Subscribe.

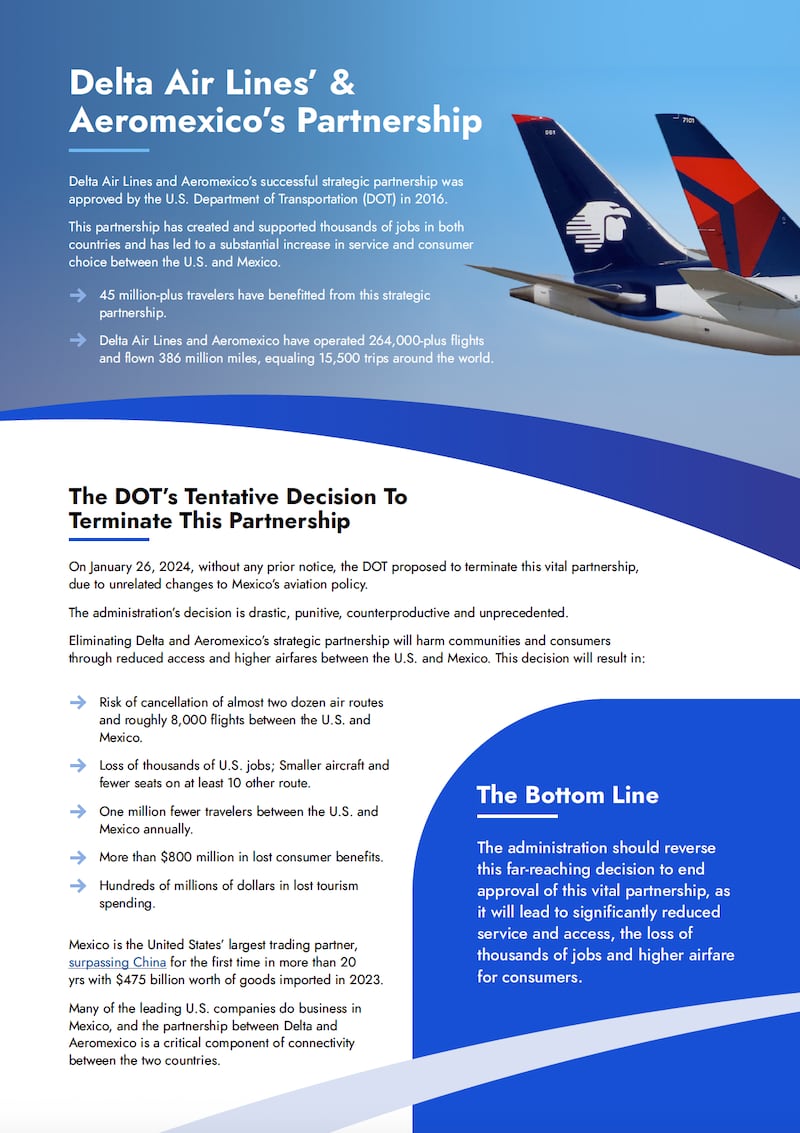

On January 26, the United States Department of Transportation (DOT) blindsided businesses and lawmakers in two different countries: an agreement allowing for easier international flights between Mexico and the U.S. could end abruptly only a few years after going into effect.

In the months since, Utah’s businesses find themselves in a holding pattern, waiting to see if the decision will keep in a final ruling expected later this year.

The deal between Delta Airlines and Grupo Aeromexico SAB, known colloquially as Aeromexico, went into effect in 2017. With Delta as Salt Lake City’s largest international airline, the DOT’s recent announcement made a particular impact across Utah: direct flights would be thrown into jeopardy, cross-border business relationships could be harmed, and the tourism sectors of both areas could take a hit.

“The dispute between the U.S. and Mexican governments, over which Delta and Aeromexico have no control, is not a rational basis for causing substantial harm to consumers, communities, the economy and transborder competition.”

— Lisa Hannah, general manager of government and policy communications at Delta

Tarmac delay

The DOT was ruling on an application for antitrust immunity that would have let Delta and Aeromexico share otherwise restricted proprietary information, like prices, to offer more than 90 flights between the U.S. and Mexico. In their rejection, the DOT accused Mexico of implementing “anti-competitive” policies at Mexico City’s Benito Juárez International Airport.

More specifically, Mexican officials moved cargo flights to a different airport outside the capital, and the DOT has accused them of harming competition as a result. But many who benefit from the easier flights view the problem as separate and easily resolved without harming the joint venture between the airlines.

“We don’t want to be creating barriers between these two nations,” says Jonathan Freedman, president and CEO of World Trade Center Utah, pointing out that Mexico is Utah’s second-largest trading partner. “We want to be better partners and build relationships.”

Utah’s business and political communities met the news with broad opposition. In February, Utah Gov. Spencer Cox wrote a letter to Transportation Secretary Pete Buttigieg, saying the deal was important because it could impact major business relationships.

“It stands to punish Utahns in order to achieve an unrelated diplomatic goal,” Cox wrote.

Freedman says there has been no response from Buttigieg.

That same month, Delta filed a 105-page objection threatening to take the DOT to court if the deal was ultimately rejected. Lawmakers and business representatives in Utah, Detroit and Atlanta — Delta’s home base — have also written letters to Buttigieg in an effort to overturn the ruling on the basis that it will harm their economies.

According to Mike Deaver, a public affairs spokesperson representing Delta, more than 250 letters have been sent to Buttigieg in opposition. In a fact sheet prepared by the airline, it estimates it could lose a million customers annually.

“[The deal’s rejection] is premature, punitive and ineffectual, and the unraveling of this procompetitive partnership would cause significant harm to consumers traveling between the U.S. and Mexico, as well as U.S. jobs,” says Lisa Hannah, Delta’s general manager of government and policy communications. “The dispute between the U.S. and Mexican governments, over which Delta and Aeromexico have no control, is not a rational basis for causing substantial harm to consumers, communities, the economy and transborder competition.”

Ripples in the sky

Nancy Volmer, director of communication and marketing at Salt Lake City International Airport, says joint venture partnerships make a “much more seamless travel experience” for customers crossing international borders. Companies can coordinate schedules, prices and other details that might otherwise be blocked off due to antitrust regulations, allowing them to align connections and reach smaller markets more easily.

The benefits of an agreement like this have a major ripple effect.

“The economic impact of a new international destination cannot be understated,” Volmer explains. “People are more willing to travel for leisure if there is a nonstop. This equates to more spending in the tourism sector. Businesses are more inclined to grow and send their employees to other markets when there is a nonstop.”

Volmer points to cases like San Antonio, Texas, and Pittsburgh, Pennsylvania. In San Antonio, the international airport has recently added five new nonstop flights to Mexico, with just a single flight to Central or South America estimated to result in an economic impact of over $36 million per year. In Pittsburgh, a 2018 study found the nonstop flight to London contributed over $50 million annually to the local economy.

Getting close to home

One group that stands to be harmed by the loss of direct routes and higher prices is Utah’s Mexican-American population. The state estimates that nearly 340,000 people of Mexican heritage live in Utah, making up about 10 percent of the state’s population and forming the basis of economic development plans and trade partnerships.

“I hope that there’s a bit of bluffing happening here,” Freedman says. “I can’t begin to speculate on strategies that are being implemented at the federal level, but I can only say that my hope is that we treat our friends better than this.”

Lastly, businesses with manufacturing and supply chains coming through Mexico could also face challenges if the DOT cancelation is upheld. For Freedman, the challenges that would pose could complicate Utah’s overall economic strategy.

“It’s been imperative in recent years to diversify and make sure that companies have strong supply chain options,” Freedman says. “It wasn’t too long ago we were in a supply chain crisis. And had we not been manufacturing or selling to a neighboring country like Mexico, … our country would not have fared well with such a bottleneck over the water.”