This story appears in the March 2025 issue of Utah Business. Subscribe.

In early February, President Donald Trump signed an executive order calling for the secretaries of the treasury and commerce to form a sovereign wealth fund within 90 days that could potentially buy TikTok.

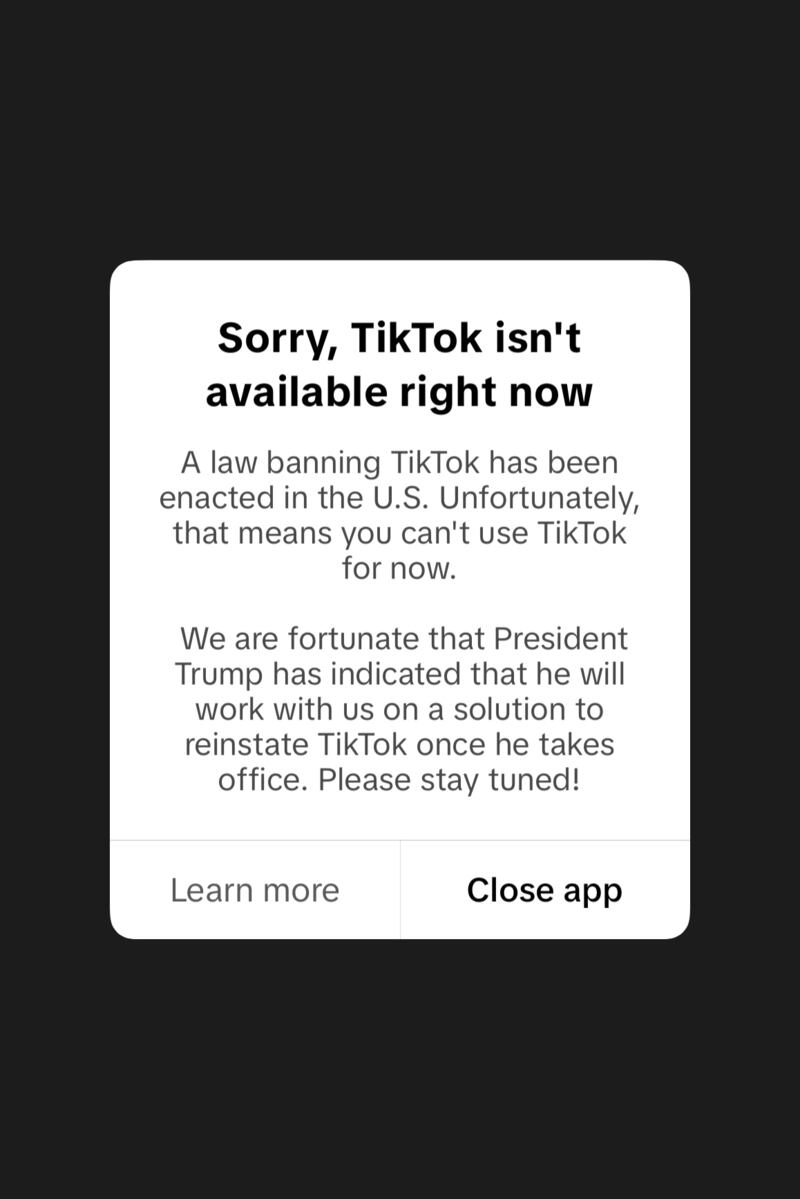

A looming ban on the app, which would make it a crime for companies to support the app while it is owned by ByteDance, was paused by Trump on his first day in office on the suggestion that the United States government and the company could work out a deal. In January, fears that ByteDance could be controlled by the Chinese government resulted in a U.S. Supreme Court ruling that a forced sale of the company was justified.

In Utah, the app’s uncertain future has left many in doubt about how to build their online brands. In December 2022, Gov. Spencer Cox issued a ban on the app for all government devices in the state, and Utah was one of dozens of states that sued TikTok on the basis that the app targeted and exploited minors.

All along, companies have been building audiences.

Businesses want brand champions

The chaos surrounding TikTok is the latest in years of posturing and questions of ownership around massive tech platforms, following Elon Musk’s 2022 contentious but ultimately forced acquisition of Twitter; a decade of acquisitions and rebranding at Meta, Facebook’s parent company; and a headline-grabbing introduction of AI into the mainstream digital media environment. Amid these public-facing battles, small channels, retailers and businesses of all sizes weather constant changes while building their brands online.

For Utah companies, social media sharing opportunities have business leaders exploring ways to convert their customers not just into one-time clients but brand advocates who share links, promotions, events and products with friends.

The options around gamified social shopping are increasing each year. Apps like Flipp, which encourages social interactions and reviews — and rewards customers by providing discounts and loyalty cards — can save users a lot of money in the long run while deepening a company’s organic reach online. Amazon and Facebook both have marketplace products, which constantly introduce more elements to shrink the distance between social interactions and digital purchases.

“You try to be scientific about it and use data, but you’re almost just looking at vanity metrics. … What TikTok Shop has done that’s so genius is open up the primary data points everybody cares about and make them totally transparent.”

— Trenton Romph

Mike Alexander, CEO of Borboleta Beauty, says his team has a large Amazon business and has been exploring different routes to engage their key customers — but the environment is new enough that they’re working on several options simultaneously.

The appeal goes beyond straight marketing into building an active relationship with customers, updating the idea of a rewards program for a more involved set of interactions. To Alexander, the upshot is that gamification can incentivize customers to participate while also sincerely recommending and engaging with the brands they like.

“I think every brand is looking for opportunities to engage their community at a higher level,” Alexander says. “Sometimes, you’re just lucky — you have these cult brand followers posting on social and talking about it with their friends. Everybody’s thinking about how you reward people for doing that.”

For example, Alexander chooses to frequent Maverik gas stations instead of larger chains like Shell primarily because a rewards program gives him a reason to support a regional business.

“That’s a local business that has [implemented] gamification. I can go get free drinks when I want just because I’m getting my gas there,” Alexander says. “Whereas, if they didn’t have those rewards, I may just go to Shell or wherever.”

By the numbers

While loyalty programs aren’t new, their integration with giant social media platforms is still evolving. TikTok Shop launched in late 2023, tapping into the app’s giant user base of over 135 million monthly active users in the United States, according to Statista. A December 2024 Pew Research Center report also found that the platform is used for more than just entertainment, as more than half of all adult users — or 17 percent of all adults in the country — said they get their news through the app. This finding reflects a shift in the tech environment that makes social platforms a kind of digital mall with everything a user might need in one place.

The Pew report also found that public support for banning the app declined in 2024, dropping to 32 percent from 50 percent a year and a half earlier. In this context, incredibly high viewership and engagement on the app makes it easy for brands and individuals to go viral, even more so than on other apps like Twitter, Instagram and Facebook.

While Facebook, YouTube, Instagram and WhatsApp all had higher numbers of registered users in 2024, TikTok users spent more time interacting with content — and that interaction translated into sales.

A February 2024 report from Sprout Social, a software firm for social media content creators that conducts research around how social media platforms work, found that 30 percent of TikTok’s daily users have used the “shop” function, a statistic that is consistent with weekly users.

As these trends emerged and distilled over the past two years, companies like Sprout Social began referring to this type of review- and sharing-based retail as “social commerce.” This process is distinct from but within the umbrella of e-commerce, which is a more broadly encompassing term for any kind of digital commerce.

“Some people look at [social commerce as] acquiring customers, keeping customers and locking people in,” Alexander says. “But it really is about saying, ‘Hey, are we taking care of our amazing customers the best way possible?’ And then making it fun for them … I think everybody wins that way.”

The core concept for Alexander is an older approach to business, centering on the clients and users involved.

“Ultimately, this is about loyal customers and how you reward loyal customers,” Alexander says. “Look at Cafe Rio. People go to Cafe Rio just to hit their punch card, right? I think this works at the smallest level.”

The digital mall

For Trenton Romph, head of marketing at Pattern, the big question is how to use this process to build an “awesome community” for the brand. Pattern — an e-commerce platform that works with companies to promote and sell their products online — had been working across several mainstream platforms like Amazon and Walmart for e-commerce, and once newer, social shopping platforms like TikTok Shop came along, they were able to integrate it into what they were already doing. They began building a team specifically focused on social marketing that could drive sales within the channel instead of more traditional advertising, and Romph already sees the deep potential involved.

“You’ve got a lot of these little shops setting up a camera and going on TikTok LIVE,” Romph says. “They show every single product in their store on LIVE — their employees just being like, ‘This dress is perfect for a night out with your husband. This dress is perfect for like a birthday party with the girls.’”

He points out that, in a mall, only a handful of people might encounter a live demonstration of products organically — but online, that potential multiplies.

“If you rotate your staff in front of the camera every now and then and run that for eight hours, you’re probably going to get at least a couple thousand eyeballs from TikTok pushing traffic to it,” Romph says. In this way, casual scrolling could naturally introduce users to the outfit they want to wear on a date that weekend or introduce them to a new place or store.

Social shopping isn’t going dark

At the same time that this embrace of digital marketing tools has taken hold, some retailers are pushing against it. By focusing on community-driven and exclusivity-based business models, some stores can build reliable and predictable budgets by offering a community-oriented and in-person experience.

This isn’t unique to small businesses. Major brands like Lush — which has stores in more than 50 countries and has become a mainstay in malls — made headlines after a 2021 decision to halt its use of social media.

“We want to explore new ways of reaching customers beyond regular social channels and unhealthy algorithms,” Lush’s creative director, Melody Morton, told Campaign in 2023. “We know we can capture a new audience by collaborating with brands and franchises that people love and follow on unique, innovative products.”

But even if/when these brands stop using social media themselves, they still have users talking about them and promoting them, either through direct ambassador programs or through word of mouth.

“One of the biggest drivers behind social shopping has always been influencer marketing,” Romph says. Sometimes, influencers work on a barter basis, while others try to implement fixed rates based on their follower count and guaranteed posts. Costs can vary wildly, leaving business owners with little insight into how much growth or sales are actually coming from these investments.

“It’s just like this wild swing,” Romph says about the rates businesses can be quoted. “You try to be scientific about it and use data, but you’re almost just looking at vanity metrics. … What TikTok Shop has done that’s so genius is open up the primary data points everybody cares about and make them totally transparent.”

With TikTok Shop making social media sales trends more predictable and understandable, more people are creating accounts dedicated to reviewing and explaining products. For Romph, these are not traditional social media influencers — he prefers to think of them as salespeople running the modern equivalent of infomercials on their channels.

And even if TikTok is fully banned in the U.S., Romph believes social shopping is here to say.

“Social shopping has been proven,” he says. “[If Tiktok gets banned], one of these big companies is going to replace it.”