For 20 years, I’ve been on a quiet mission to change the way people think about money. More specifically, I’ve spent two decades trying to redefine the word “budget,” a term ripe with restriction, guilt and cutting back. But the truth is, I’m ready to wave the white flag. Our team couldn’t change the meaning of “budget,” but we accomplished something far more important: YNAB has helped people love how they spend. And that’s what really matters.

My journey from building a simple spreadsheet to the company we are today was far from a straight line. When I first created YNAB, the goal wasn’t to start a business. It wasn’t to build a software company, a movement or even a philosophy. I just wanted to graduate from college debt-free and still afford the occasional donut.

In the process of building YNAB, I accidentally discovered a new method for money management. And then I realized that it wasn’t a budget people needed after all (an awkward discovery after naming a company You Need A Budget). What they actually needed was a completely different mindset around money.

The spreadsheet that changed my life

Back in 2004, I was a newlywed, a broke student, and a soon-to-be father with a burning desire to avoid any student loan debt. I’d always been pretty careful with my money, but the reality of our finances was quickly catching up with us. That’s when I built a spreadsheet that helped my wife, Julie, and me manage our money better.

I’d like to say that the moment I finished the spreadsheet, I knew it would change lives. But actually, I was just trying to pay the bills. I tweaked the spreadsheet here and there, made it work for our fluctuating income, and kept moving forward. It wasn’t until later that I realized the rules I had built into that spreadsheet — what eventually became the YNAB Method — were the real game-changers.

Back then, YNAB wasn’t a business or even a vision; it became a side project after I realized I could sell the spreadsheet to help pay rent. I was working long hours as an accounting intern at KPMG, pulling overtime to make ends meet. YNAB started bringing in a little cash, but it nearly didn’t make it.

Our first sale went to a Mac user, except YNAB didn’t work on Mac at the time. I still remember the sting of that return, but looking back, it wasn’t a defeat. It was validating. Someone had bought it in the first place! That’s when I realized we might be onto something.

The early years of YNAB

The early years of YNAB were anything but glamorous. There were plenty of moments when it didn’t feel like a real business — at least not one that could last. I was still working overtime as an accountant, and YNAB was more of a side project than a full-time gig. Honestly, I’m glad it started small. It didn’t feel overwhelming, and the next steps always seemed obvious.

But there was a moment when I almost quit. I wasn’t sure if I could keep pouring energy into something that wasn’t yet standing on its own. The numbers just didn’t add up. But one thing kept me going: I believed in the idea of helping people line up their spending with their priorities. That mission was enough to keep pushing forward, even when things were uncertain.

Julie was my rock through all of it (and still is). During those early years, she was the one who kept me grounded, reminding me to keep our family at the center of it all. “Don’t forget we’re still here,” she’d say when I got lost in the work. Without her steadying presence and those gentle reminders, I don’t think YNAB would have made it.

The method behind the magic

As the spreadsheet evolved, I realized we weren’t just tracking numbers. We were following a method — one that could be applied to anyone’s life. The Four Rules weren’t something I set out to create; they just kind of emerged as I figured out how to manage our money.

At first, YNAB was just a budgeting tool, unique in that it used a zero-based system. But as I talked with more people who were using it, I realized it was becoming something much bigger. People weren’t just balancing their checkbooks; they were building the lives they wanted, making big changes, and setting and achieving goals they thought were impossible. They weren’t talking about cutting back or depriving themselves. They were talking about starting families, buying homes and retiring early. YNAB wasn’t just an expense tracker. It was a method for self-actualization.

Building a great place to work

As YNAB grew, I quickly realized that I couldn’t do it alone. Hiring terrified me, but the right team makes all the difference. What I learned early on was that you can’t teach passion. It wasn’t about finding the most polished resume; it was about finding people who genuinely cared about what we were building.

Take Taylor Brown, for example. He emailed me out of the blue in 2006 with some incredible ideas about the product. No formal interview, no drawn-out process (our initial dozen emails all happened within the first 24 hours of “meeting” online). We partnered to build YNAB as standalone software from the ground up because he got it. He understood the vision, and his passion for improving the product has shaped our entire trajectory. Today, Taylor is our technical fellow, driving at the very cusp of innovation and helping make YNAB better every day.

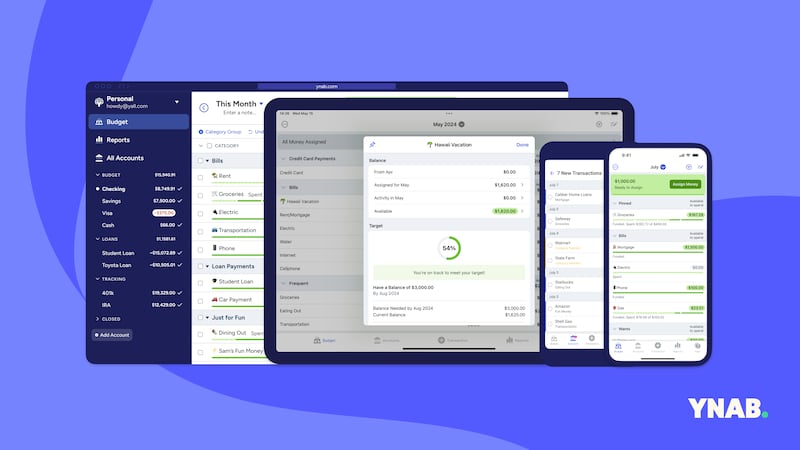

And then there’s Sebastian Hubrich, our head of technology. Back when YNAB was still downloadable software, Sebastian had the guts to email me from Switzerland: “Let’s make it an app.” I was hesitant at first (who would want to manage their money on a tiny phone?), but he pushed us into the world of SaaS, which completely transformed YNAB. Now, our app reaches millions of people, and Sebastian is still here, helping us evolve and grow in ways I never imagined.

Erin Lowell and Dave Crombleholme, our veteran educators, are another example of how the right people can take something good and make it great. They understood that YNAB wasn’t just a tool — it was a framework that needed to be taught. Along with our other teachers, they’ve run countless free workshops, webinars and community events, helping people from all walks of life learn how to give every dollar a job. Erin and Dave are still at YNAB today because they’re driven by that same mission: to help people discover themselves through money. And that’s why, 20 years later, YNAB is still going strong.

Embracing change as the YNAB way

One thing I’ve learned over the years is that change isn’t just necessary; it’s everything. Flexibility has been at the heart of YNAB’s growth from day one. We’ve changed our name, our method and the way we teach. We also stumbled upon a whole new category, but I’ll get to that later.

Take The Four Rules. They didn’t start fully formed, and we’re still not done changing them. But the insight I had in my 20s about the method being a game-changer still holds true. We’ve now distilled it all down to one core principle: “give every dollar a job.” Everything evolves. That’s how progress happens, and that’s how we keep moving forward.

The biggest change, though, was stepping back as CEO. Passing the torch to Todd Curtis was one of the hardest decisions I’ve made, but I knew it was the right move. Under Todd’s leadership, we’ve grown in ways I never could have imagined. YNAB needed fresh day-to-day and strategic leadership to reach its full potential, and I needed to get back to what fires me up: spreading the word about the unexpected benefits of intentional spending.

The YNAB community: A die-hard fanbase

What surprised me the most was the community that popped up around YNAB. People were living the YNAB Method. I’ve seen YNAB license plates, tattoos and even wedding vows where we get a mention. And they were doing things with their money that I never could have predicted.

We don’t tell people how to spend their money; we just help them become aware of what their money is already doing and encourage them to make intentional decisions. Our users write in with stories about their spending choices, ones I would never personally make, and that’s the beauty of it. Spending is personal. When people align their money with what truly matters to them, you can see their real selves start to shine through. Their spending tells their story.

The stories I hear still amaze me. Countless couples have avoided divorce because they finally got on the same page with their finances. Users have quit smoking — not because they were trying to save money, but because they finally saw how much it was holding them back from their other goals. These aren’t just wins with money; they’re life wins. And that’s what YNAB has always been about: helping people change their relationship with money so they can live the life they want.

But there’s still one thing that frustrates me: Why aren’t a hundred times more people using YNAB? The transformation is real. We’ve seen it in hundreds of thousands of users. So why hasn’t the rest of the world caught on? It’s the question that drives us every day, pushing us to reach more people with a message that goes far beyond budgeting.

Shifting the focus from budgeting to intentional spending

After all these years, we’ve stopped trying to change the meaning of “budget.” Instead, we’re asking a far more important question: “How do you want to spend your money?” It’s a simple but radical shift in mindset, one that most people don’t ask themselves. Too often, money is framed in terms of control — cutting back, saving for a rainy day and being responsible. But that’s not the whole story.

Over time, I realized that money is far more personal than we think. The way you spend says a lot about what matters in your life — your priorities, your hobbies, goals and dreams. At YNAB, we’re helping people use their money in a way that reflects who they are and what they care about most.

We call it “spendfulness.”

Spendfulness is finally putting as much care into how you spend your money as you do into how you earn it. Spendfulness is the recognition that few things shape our health, relationships and overall well-being as much as money. It’s spending $50 to take your kid to a Minor League Baseball game before those opportunities pass you by. Money is an opportunity that many realize too late. After all, it’s meant to be spent.

From education to UI to marketing, we’ve shifted our entire focus from building the best budgeting software to teaching spendfulness. When you ask yourself, “How do I want to spend my money?” everything changes. You stop second-guessing and stop feeling guilty about small indulgences. You start feeling more in control — not just of your finances, but of your future.

The next 20 years of YNAB

As YNAB celebrates its 20th anniversary, people ask me all the time what my exit strategy is. I don’t have one. Death, I suppose.

I’ve always thought about starting a business the same way I think about money. Why would I want an exit strategy from something that I’ve poured so much time, energy and effort into? The joy is in the journey, not in the exit. I’m not waiting to “cash out.” The value is in building something every day that makes a meaningful difference in people’s lives.

I don’t know exactly what the next 20 years will bring, but I do know this: YNAB will continue to help people transform their relationship with money and themselves. We won’t redefine the word “budget,” but we will keep helping people build lives that reflect their values, one dollar at a time.

As for me? I’ll be here, evangelizing spendfulness and waiting for the world to finally realize that money isn’t a tool — it’s an extension of you.