This story appears in the August issue of Utah Business. Subscribe.

Ten years ago, Dan Beck decided to offer retirement benefits to employees in several of the small businesses he had started. Wanting to set up 401(k) plans because of their higher contribution limits, Beck dove into deciphering industry jargon and uncovering hidden fees.

“I was so confused,” he says. The costs were so high for his small businesses that he ultimately abandoned the idea.

But out of the confusion and frustration, his entrepreneurial spirit “came to life.” Beck and his brother spent two years developing a solution for small business owners that, in 2019, became 401GO.

The business has doubled every year since.

Today, the Sandy-based company provides retirement plans to more than 2,700 companies throughout the United States — and 75 percent of them are offering their workers 401(k) plans for the first time.

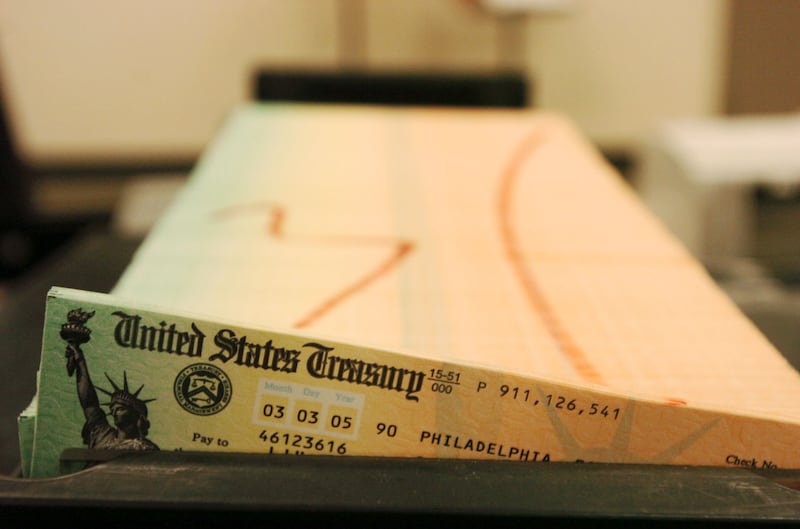

That’s good news, as national alarm bells sound about the fate of social security alongside the swelling number of boomers who will turn 65 by 2030. According to a recent study, two-thirds of them haven’t saved enough, and Pew Charitable Trusts estimates that financially strapped retirees will increase state government spending by $334 billion over the next 20 years to compensate.

According to AARP, “Americans are 15 times more likely to save for retirement when they have access to a workplace plan.” And yet, those plans are only available to about two-thirds of private industry workers. That number drops to less than half for companies with fewer than 50 people.

While small business owners often cite cost as the main obstacle, lack of time is another impediment. For many startups and small businesses, “the CEO is also the CFO and everything else in between. It’s hard to add one more item to watch over,” says Joseph L. Taylor, a financial advisor with Intermountain Financial Planners.

Beck, 401GO co-founder and CEO, says a business owner who knows nothing about retirement benefits can use 401GO’s guided, online process to set up a 401(k) plan in 15 minutes, drastically faster than the five-week average he says he sees with traditional providers. Proprietary software and robo-advisors automate mundane tasks to make the process more efficient. However, Beck quickly points out that robots aren’t good at everything. He calls 401GO’s approach “high-tech as well as high-touch,” a key factor to the company’s client retention rate of 99 percent. “It almost always comes down to service,” Beck says.

Federal legislation passed in 2022 is helping offset costs, too. With SECURE Act 2.0, companies with fewer than 50 employees can claim a tax credit equal to 100 percent of the cost of establishing a retirement plan, up to $5,000 per year for three years. Employers who offer employees matching contributions can claim more.

“For typical small business owners, it doesn’t cost $5,000 to get set up,” says John Stanton, VP of retirement services operations at Insperity. That’s especially true “if you’re willing to go with the standard version rather than the Cadillac version,” he says. Stanton routinely advises small business owners to keep it simple, allowing for lower costs, easier administration and higher participation.

Some state governments have taken additional action. According to a tracker maintained by Georgetown University, 16 states (Utah isn’t one) now require employers without retirement plans to automatically enroll their employees into state-sponsored individual retirement accounts.

As for Beck, he included automatic enrollment into 401GO’s 401(k) plans from the start. He says it significantly increases plan participation and helps workers overcome “the first dollar hurdle” — the notion that the hardest dollar to save is the first one.

Cameron Poulsen was one of Beck’s early employees who benefited from auto-enrollment when he was 19. Now 23 and having consistently contributed, Poulsen’s 401(k) balance exceeds $45,000. “The first $10,000 is the hardest,” Poulsen says. Then, compound interest takes over. “If you just let it do its thing, you won’t be mad at it.”

Taylor recommends that his clients increase their 401(k) contributions by 1 percent annually. If it breaks their budget in six months, he’ll buy them a steak dinner.

“It never happens,” he says. “Most employees are going to find if they begin saving, they get acclimated to it. … They don’t miss that money.”